2024 Form 2024-Es Payment Voucher Printable

2024 Form 2024-Es Payment Voucher Printable. As we approach the 2024 tax year, it's crucial for taxpayers, particularly those without withholding, to understand the estimated tax payment. * first name taxpayer's first name is a required field.

Here’s what the 2023 tax year payment schedule looks like: Individuals and businesses impacted by the san diego county floods qualify for an extension to pay their april estimated tax payment.

On Or Before April 15, 2024.

Solved•by intuit•95•updated march 31, 2023.

Complete The Worksheet Below To Automatically Create Your Payment Voucher.

Solved•by turbotax•2439•updated 1 month ago.

Solved•By Turbotax•4622•Updated December 11, 2023.

Images References :

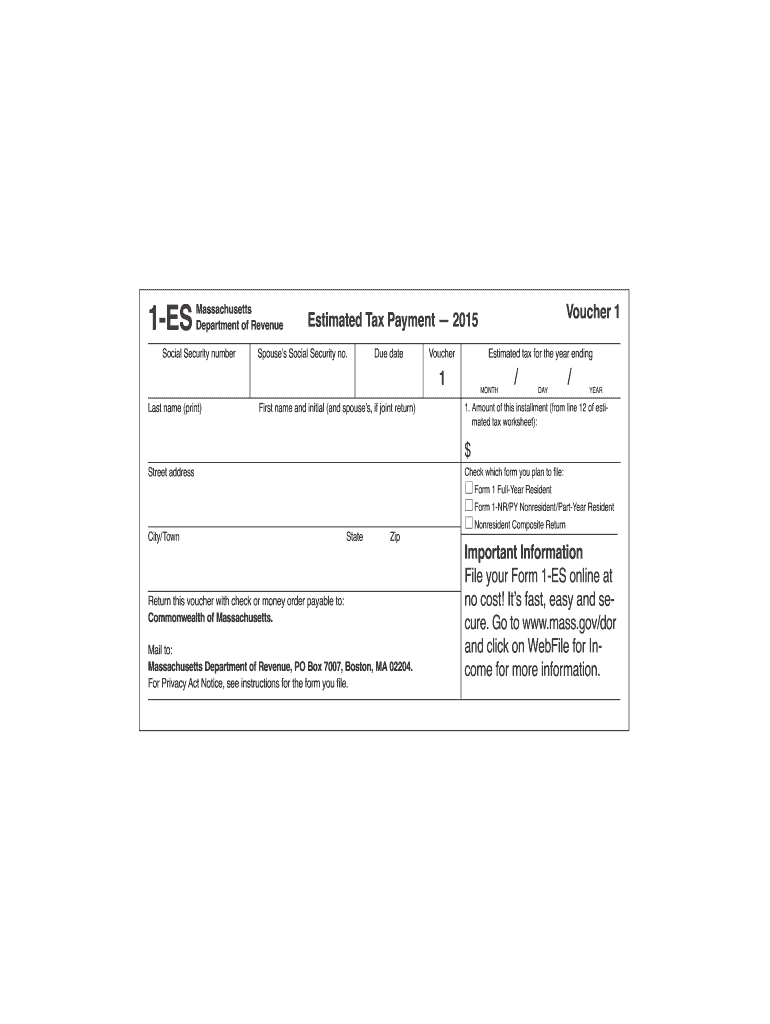

Source: www.signnow.com

Source: www.signnow.com

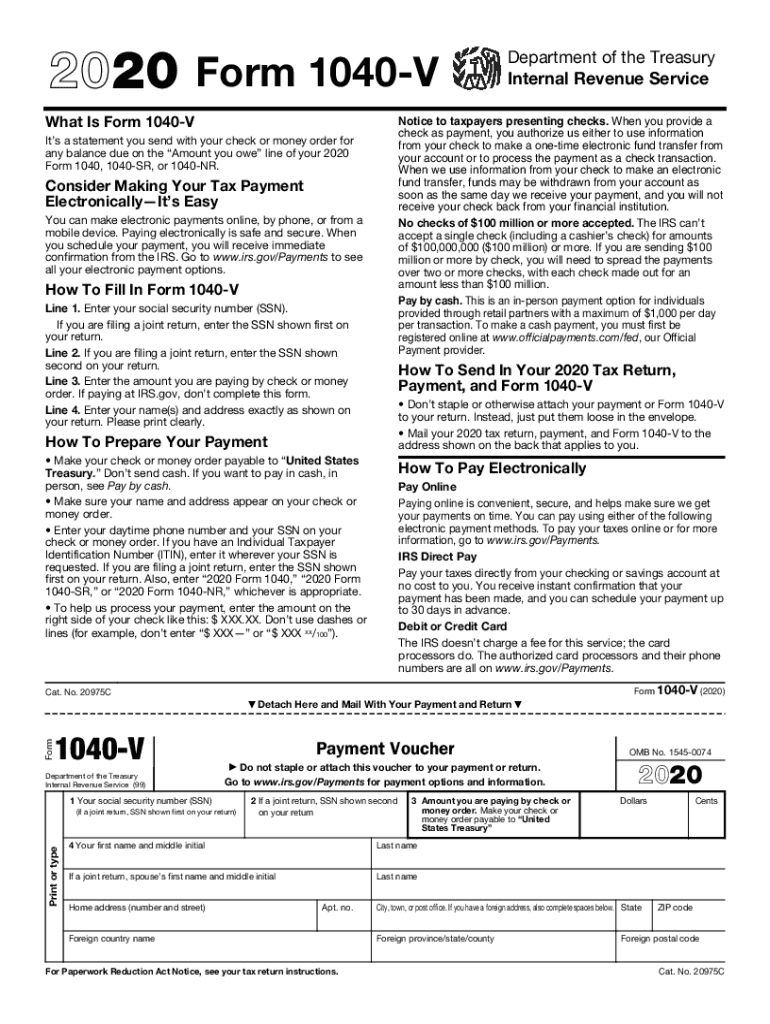

Payment 20202024 Form Fill Out and Sign Printable PDF Template signNow, Solved•by turbotax•4622•updated december 11, 2023. September 16, 2024* payment voucher 4:

Source: www.formsbank.com

Source: www.formsbank.com

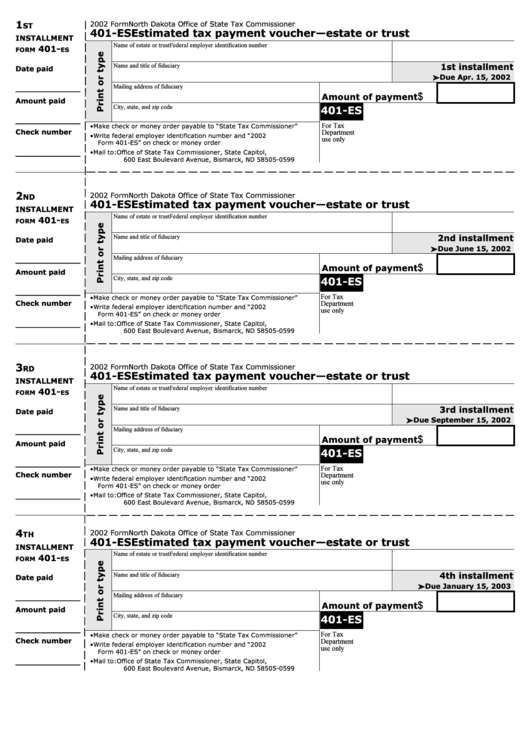

Form 401Es Estimated Tax Payment Voucher 2002 printable pdf download, How do i print estimated tax vouchers for my 2024 taxes? The form is not fully and correctly filled out.

Source: www.signnow.com

Source: www.signnow.com

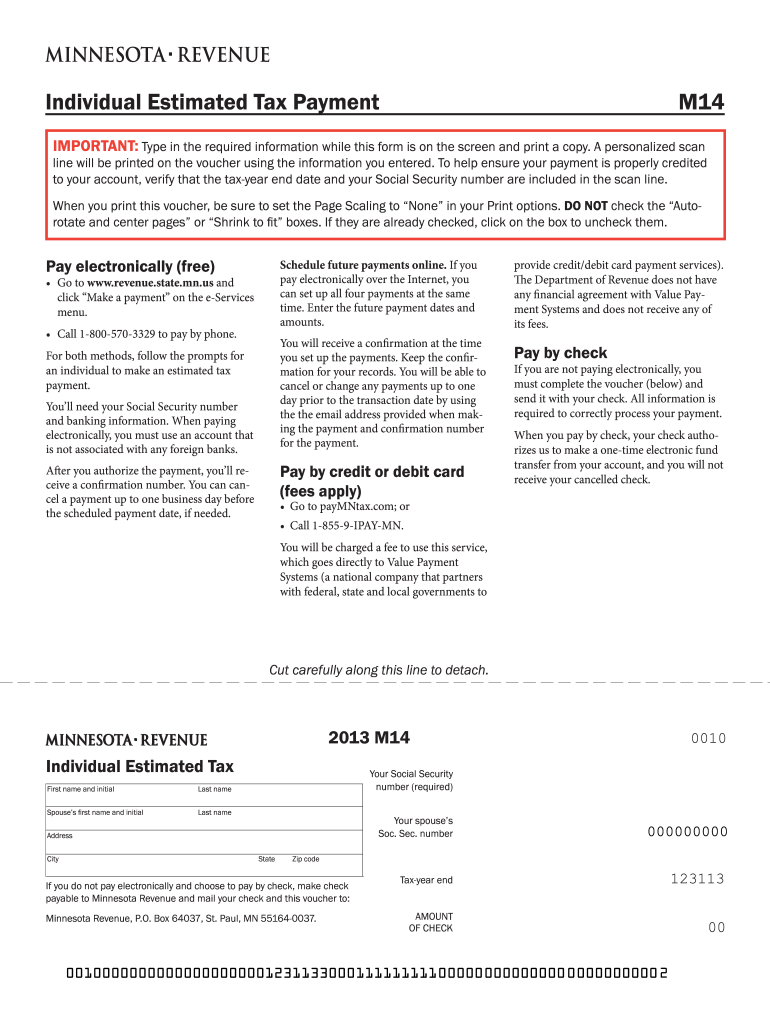

Minnesota Estimated Tax Voucher 20132024 Form Fill Out and Sign, (note that some people will have extended irs tax deadlines for estimated tax payments due to residing. Select the correct wisconsin payment.

Source: www.formsbank.com

Source: www.formsbank.com

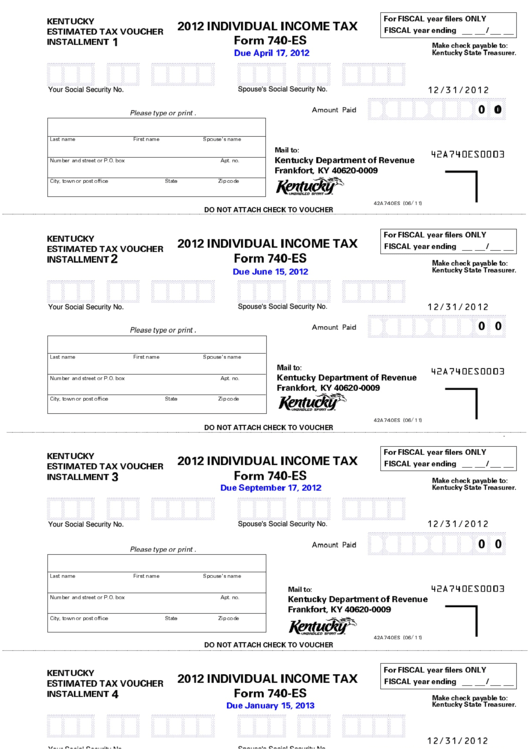

Fillable Form 740Es Individual Tax Estimated Tax Voucher, September 16, 2024* payment voucher 4: The form is not fully and correctly filled out.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Complete the worksheet below to automatically create your payment voucher. Solved • by turbotax • 1408 • updated november 23, 2023.

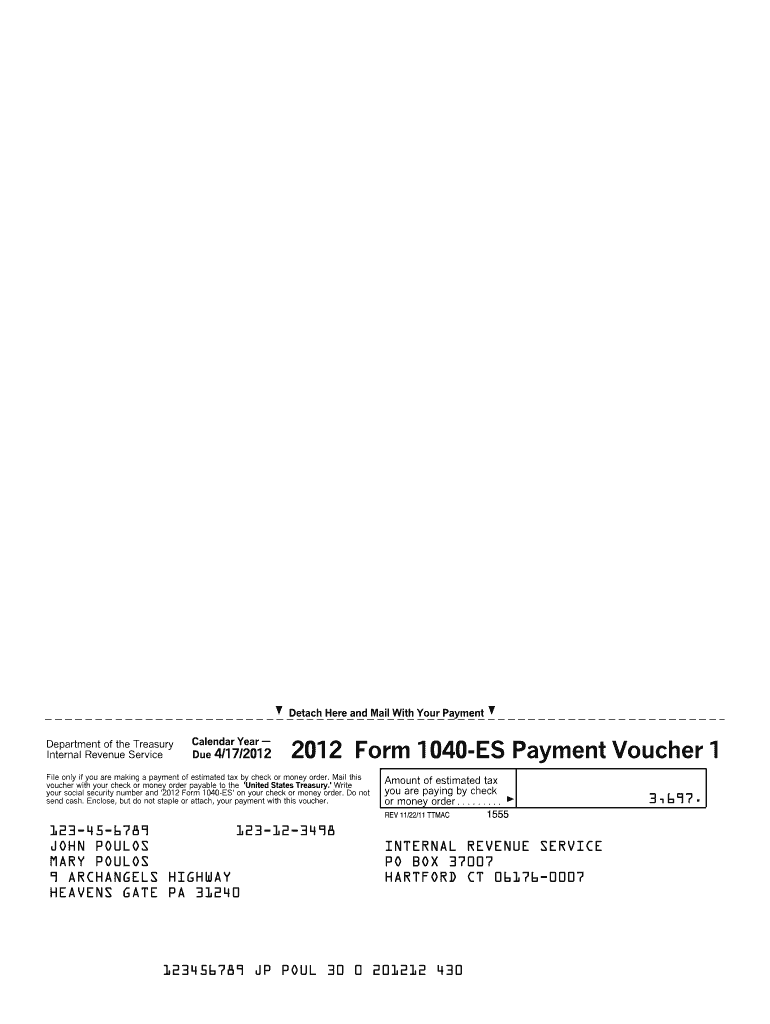

Source: www.dochub.com

Source: www.dochub.com

Wisconsin estimated tax payment fillable 2012 form Fill out & sign, The table below shows the payment deadlines for 2024. If first voucher is due on april 15, 2024, june 15, 2024, september 15, 2024, or january 15, 2025, enter 25%, 33%, 50% or 100%, respectively, of line 11 (less any.

:max_bytes(150000):strip_icc()/Screenshot2023-03-08at1.26.28PM-98e7ddc6d0904f378d870265beee5942.png) Source: www.investopedia.com

Source: www.investopedia.com

Form 1040 V Payment Voucher and IRS Filing Rules, Voucher #1 due april 15, 2024 voucher #2 due june 15, 2024 voucher #3. Complete the worksheet below to automatically create your payment voucher.

Source: www.dochub.com

Source: www.dochub.com

Form 1040 es Fill out & sign online DocHub, How do i print estimated tax vouchers for my 2024 taxes? Here’s what the 2023 tax year payment schedule looks like:

Source: www.pinterest.com

Source: www.pinterest.com

Form 1040 ES, Estimated Tax for Individuals Internal Revenue Service, If you file your 2023 tax return and pay the balance due by january 31, 2024, you do not have to make. This option will not electronically file your form.

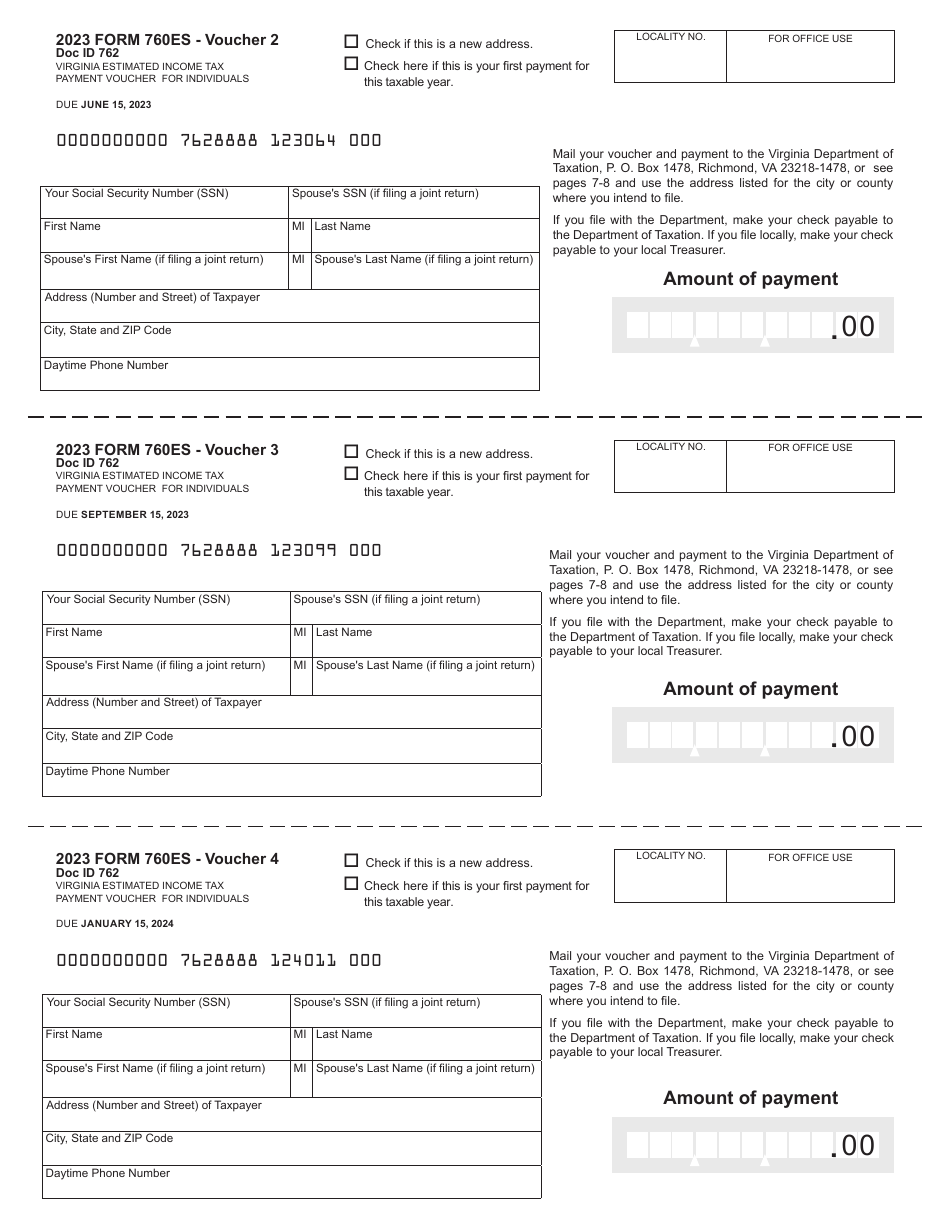

Source: www.templateroller.com

Source: www.templateroller.com

Form 760ES Download Fillable PDF or Fill Online Virginia Estimated, As we approach the 2024 tax year, it's crucial for taxpayers, particularly those without withholding, to understand the estimated tax payment. Use of any of the personalized vouchers below ensures that your tax payment is timely posted by the department to the correct account.

Select The Correct Wisconsin Payment.

Generally, your estimated tax must be paid in full on or before april 15, 2024, or in equal installments on or before april 15, 2024;

Individuals And Businesses Impacted By The San Diego County Floods Qualify For An Extension To Pay Their April Estimated Tax Payment.

September 16, 2024* payment voucher 4: